About Form 2290, Heavy Highway Vehicle Use Tax Return Use Form 2290 to: Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period; Figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases and the vehicle falls into a new category; Claim suspension from the tax when a vehicle is expected to be used 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period; Claim a credit for tax paid on vehicles that were destroyed, stolen, sold, or used 5,000 miles or less (7,500 miles or less for agricultural vehicles); Report acquisition of a used taxable vehicle for which the tax has been suspended; Figure and pay the tax due on a used taxable vehicle acquired and used during the period.

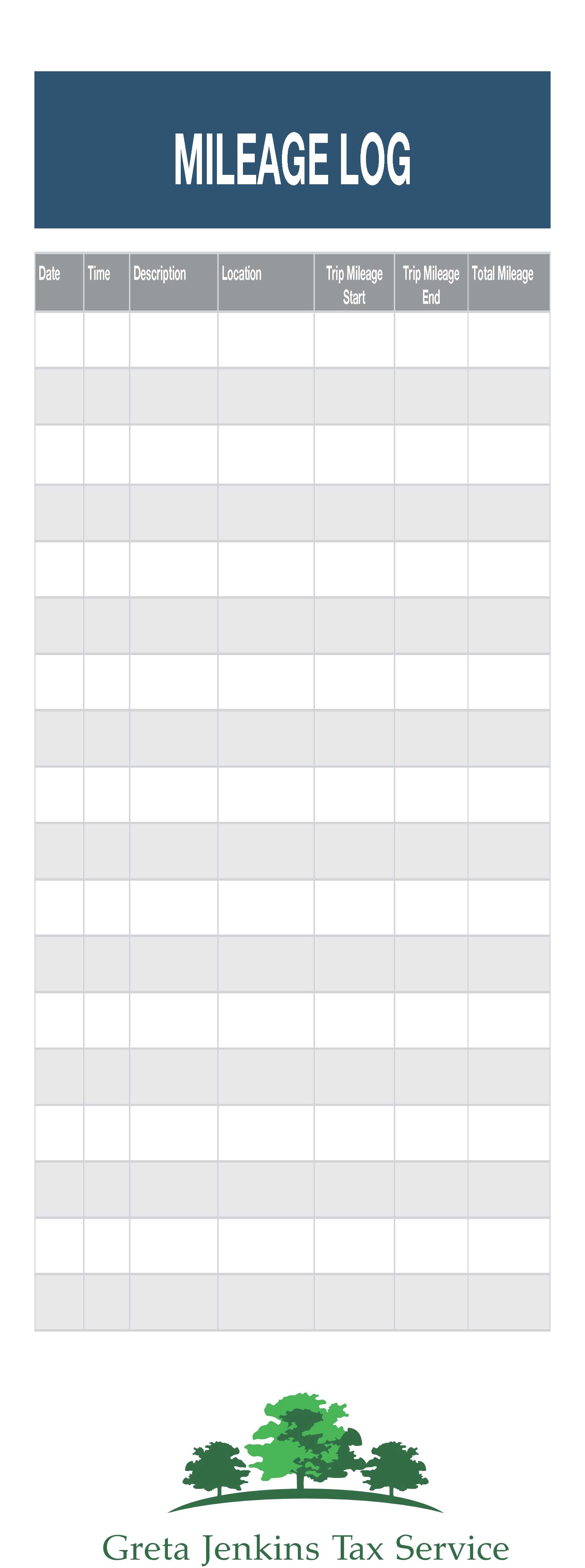

Keeping an accurate track of your vehicle’s mileage could save you big at tax time. So we’ve created this free mileage calculator to help you deduct the costs of operating a vehicle for business, charitable, medical, or moving purposes on your taxes or to calculate your business mileage reimbursement. You can also print our blank printable mileage log and fill in your miles below and email the log to yourself.

-c9f0f.jpg)